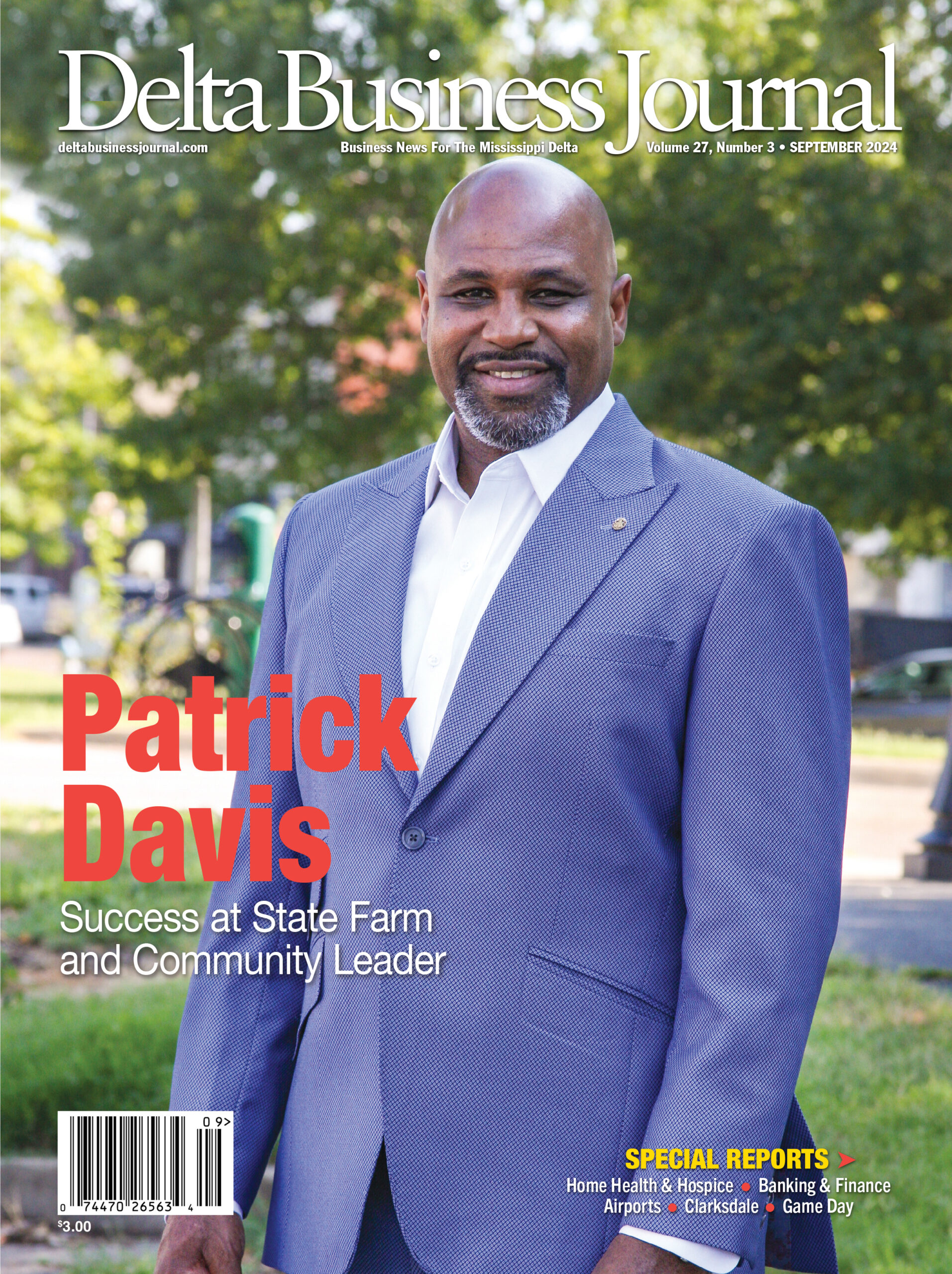

Success at State Farm and Community Leader

State Farm, the largest insurance company in the country, is known for choosing agents who are very highly regarded in their communities. Patrick Davis, Owner Agent for the State Farm Insurance Agency in Cleveland, works hard to help customers understand what kind of insurance coverage they need, and he is passionate about life insurance. He is also well known as someone who helps make the community a better place.

“I am proud to be part of the community,” says Davis, a former president of the Delta State University (DSU) National Alumni Association. “I volunteer in a lot of areas. I give scholarships. I help with providing back-to-school supplies. I am a member of booster clubs that help with athletic programs. I think people in the community like it when they see business people rolling up their sleeves and doing the work.”

Jeffrey Farris, vice president\relationship banker with Guaranty Bank & Trust, Cleveland, has frequently volunteered with Davis including with DSU and the Cleveland Chamber of Commerce.

“I think the world of Patrick,” says Farris. “He is a loyal person of good character. He is someone I’ve been involved with in many different organizations. He is a good listener and, when he gets involved in a project, he has a passion for it. And he is a good cook. He is a monstrous chef when it comes to ribs. As a businessman, he has been very successful. He is also an outstanding family man.”

A resident of Cleveland since 2009, Davis graduated from O’Bannon High School in Greenville before attending DSU where he earned a BBA with an emphasis in accounting, management and computer information systems.

Davis took a course in insurance at DSU. To fulfil a requirement to do an internship, he went to a job fair on campus where he was offered work from Northwest Financial—now Wells Fargo—and State Farm. After graduating from college in July 1995, he went to work for Norwest Financial, but was later approached by State Farm. He worked as a claims representative in Birmingham, Ala., and for a number of years in underwriting management before moving back to Cleveland.

He is approaching his twenty-ninth year with State Farm with nine of those years handling claims throughout Mississippi and Alabama. He worked for five years in underwriting management and in February, 2025 will celebrate fifteen years as an Owner Agent with State Farm.

“I’m always looking to grow my team and now have four full-time members in the office and four part-time/remote team members working in different capacities,” says Davis. “I manage efforts and systems and choose to lead people who believe in taking care of customers.”

There are many things he enjoys about his work. But, most importantly, he feels rewarded by being able to serve in different volunteer capacities throughout the City of Cleveland, as he gives back to the community that supports him.

What is the hardest part? That is helping customers understand the difference between their insurance contract and what they want when there is a loss.

“It is disappointing when we cannot completely please our customers,” says Davis. “There are times when customers, and I can understand why, only focus on the less expensive price versus gaining an understanding of what comes with that price. Some people don’t take enough time to communicate with an agent who is able to explain coverages and give them options so that they can make an informed decision.”

Home insurance costs have been increasing, but Davis recommends that when people are looking for a home to buy, they should budget in a realistic amount of insurance rather than letting that be one of the last things to consider. Doing this helps home buyers determine what is affordable for them.

Auto insurance costs are also increasing, particularly for the new smart vehicles with additional features like automatic braking, backup cameras and lane department warnings. While those features can save lives, breaking a windshield in a smart car can be very expensive to repair. Davis says as technology improves, and more bells and whistles are added, the cost to repair or replace them increases. So does the cost to insure them.

Davis likes to conduct a review of people’s home or business policies every two years. He looks for opportunities for them. Sometimes people have a claim and realize that they didn’t have the coverage they needed and want to correct that. But it can be hard sometimes to get customers to come back in.

“We are all so busy,” he says. “But one thing we pride ourselves on is going into detail explaining coverages so people know what they are paying for. We hope people never have to use their coverage because that means something has happened to interrupt their lives. But, if they do, we want to make sure they have enough coverage to repair their property. A lot of people don’t understand the difference between what they paid for their house and what it would cost to rebuild it. It is our responsibility to make sure we are able to keep up with inflation for our customers. The worst thing in the world that can happen is you have a total loss on your house and don’t have enough coverage to rebuild. The cost of goods and services, parts, materials and labor increase annually. Banks want to make sure the loan is covered; we want to make sure we can give you enough to rebuild your home.”

In some areas of the country, hail has become more frequent and damaging. Hail is a peril covered under standard home policies. Davis recommends having a professional get up on the roof after a hail storm to access damage. People standing on the ground won’t see the damage that can create an opportunity for shingles to deteriorate over time. When replacing a roof, Davis always recommends using a local contractor with good references as opposed to traveling roofers who will leave town and not be available if a problem develops.

Some people falsely assume an insurance policy can be used for maintenance; you can just call and ask for a new roof when it wears out. They don’t realize a loss has to occur. Shingles have a finite lifespan. If your roofing shingles have exceeded their lifespan, you are putting your property and home at risk.

“Don’t wait for a storm to occur to replace your roof,” says Davis.

Trees are necessary for shade and beauty, but don’t let them grow dangerously close to your home. Limbs should not overhang roofs. Davis says it is also important to check the health of trees near the home, and replace ones that are diseased or dying.

One of the top recommendations for business owners to protect their investments is to have proper liability coverage to protect them from lawsuits. You need property coverage for buildings and materials, and business interruption insurance to bridge the gap if something happens and the business isn’t able to function for a while.

“You need to sit down with an agent and talk about what exposures you have and what insurance is needed to build a proper policy to protect you in all scenarios,” he says. “The key to it all is effective communications.”

Davis has been married to his high school sweetheart, Tomeka, now for twenty-six years. “We have the best two kids in the world, Courtney Davis Flowers, who is married to Semaj Flowers, and Patrick (PJ) Davis, Jr.,” he says.

Photography by Holly Tharp